The great debate of renting versus buying Boise homes sparks lively conversation. Because each option has its benefits and downsides, the answer usually depends on each individual’s unique situation. But how do you decide which option is better for you? What if neither option suits your needs?

This guide outlines each of the notable pros and cons, plus a third pick that might be the perfect fit if renting or buying seem imperfect for your situation.

Renting in Boise

Renting is an outstanding option for Boise residents unsure of whether they want to put down roots. It offers superior flexibility and ample opportunities, but like most things, it isn’t all sunshine and rainbows.

Pros and Cons

Renting can be ideal for Idaho residents seeking a more temporary solution. It offers an array of benefits, including the following:

- Flexibility: You can come and go as you choose, leaving when your lease is up to seek a better opportunity. This flexibility is a notable perk for wandering nomads who enjoy flitting from one place to another.

- Limited responsibility: While you must abide by the terms of your lease agreement, your responsibility surrounding the property is limited. You don’t need to worry about maintenance costs and repairs (for the most part), making renting relatively worry-free.

- Pricing: Renting can be cheaper than buying a home, you don’t have to worry about maintenance, repairs, property taxes, and other hassles associated with homeownership. Of course, this factor hinges on the rental property you choose.

Of course, renting has its downsides:

- Rent increases: Idaho landlords are free to raise rent as they wish, as there is no limit on the number of times a landlord can increase rent if there isn’t a provision in the lease. Over time, you could face lofty, stressful rent increases.

- Lease agreements: When you sign a lease, you’re legally bound by the terms outlined in that agreement.

- Eviction: If you violate your lease, your landlord could evict you anytime, providing they have reasonable cause.

- Tax benefits: Unlike owning a home, renting offers no tax benefits, such as deductions of home mortgage interest, home equity loans, or mortgage points.

- Pet ownership: Finding a pet-friendly rental can be tricky, especially if you own a large breed dog. And considering Idaho was ranked as the state with the most dog owners, this poses a problem.

What to Expect: The Cost of Renting

Renting a home can be cheaper than buying, but it’s far from free. On average, most Boise renters pay around $1,750, approximately 17% lower than the national median cost of $2,100 per month.

Of course, the monthly cost of renting a home or apartment depends entirely on factors specific to the property. For example, the size of the house, the number of bedrooms, location, and amenities (if applicable) can significantly contribute to the price of your monthly rent payment.

Finding that perfect rental can be a chore, especially if you have a larger family, want a sprawling space, or need specific features and amenities. However, these drawbacks are nothing more than a speed bump for some.

Buying a Home in Boise

If the prospect of renting doesn’t sound ideal, buying a home might be a suitable alternative. When you buy a home, you get a permanent place to call home. It’s somewhere you can craft cherished memories with your friends and family and create a cozy, welcoming hub to host gatherings with those you love most.

Pros and Cons

Buying a home in Boise can be a phenomenal option, as it offers numerous advantages over renting, including:

- Investment: A home is an investment. Instead of paying money to a landlord, you buy into your own home equity.

- Credit improvements: When you buy a home and regularly pay your mortgage, your credit score will increase. Of course, other factors impact your credit score, but on-time mortgage payments build up your score.

- Superior control: When you buy a home, you get complete control over the goings on inside your home. Want to tear out your kitchen to build your dream layout? Go for it! Hate the bathroom shower setup? Tear it out and start from scratch! Your home is clay, and you’re the potter – you can shape it to match your preferences.

- Stability: Unlike renting, you enjoy long-term stability after buying a home. You’re not living under a set lease agreement, which gives you better stability for your future living situation.

- Tax benefits: When owning a home, you enjoy various tax benefits, including deductions of your mortgage interest, property taxes, and even some home improvement projects.

But while home buying is an excellent option, don’t forget to consider the drawbacks:

- Steeper upfront costs: Buying a home is often much pricier than renting, especially in upfront fees. A down payment, closing costs, and move-in expenses add up. However, mortgage payments can be comparable to rental payments.

- Responsibility: When you own your home, you’re responsible for all maintenance and repairs. There isn’t a landlord to sweep in and handle them for you – it’s up to you.

- Property taxes: While property taxes can qualify as a deduction on your tax return, you’ll still need to pay them, among other fees associated with owning a home.

- Limited flexibility: When you buy a home, flexibility walks out the door. Of course, you could sell shortly after purchasing, but moving on to the next best thing isn’t as easy as ending your lease in a rental agreement.

Understanding the Buying Market

For some, buying a home is the best option. Between the tax benefits of owning a home and the stability it provides, it’s no surprise that many choose to become homeowners and join the 68.5% of Americans who own a home.

The buying market in Boise looks drastically different than the rental market. While both markets share some of the same woes, such as the complicated process of finding a home that matches your unique needs, it’s essential to understand the definitive differences between the two.

The most notable difference between these markets is the steep upfront cost. Unlike renting, you’ll likely fork over a sizeable chunk of change as a down payment on your home. After that, your mortgage payment might look similar to a standard rent check, sometimes even smaller.

Some estimates pinpoint the average monthly mortgage payment at around $1,155 per month, which is substantially less than the average rent payment of $1,750. Of course, costs are entirely dependent on factors specific to your situation, including the house size, your interest rate, and the home’s location.

The average Boise home features a list price of approximately $599,000 or around $310 per square foot. It’s important to note that these costs hinge on factors specific to the home, so some new homeowners may pay more or less for their new homes.

In some cases, buyers may pay more for their homes, with about 32% of home sales selling over their listed prices. This stems from competition in the buying market, causing home buyers to offer more than the list price to increase their chances of purchasing the home.

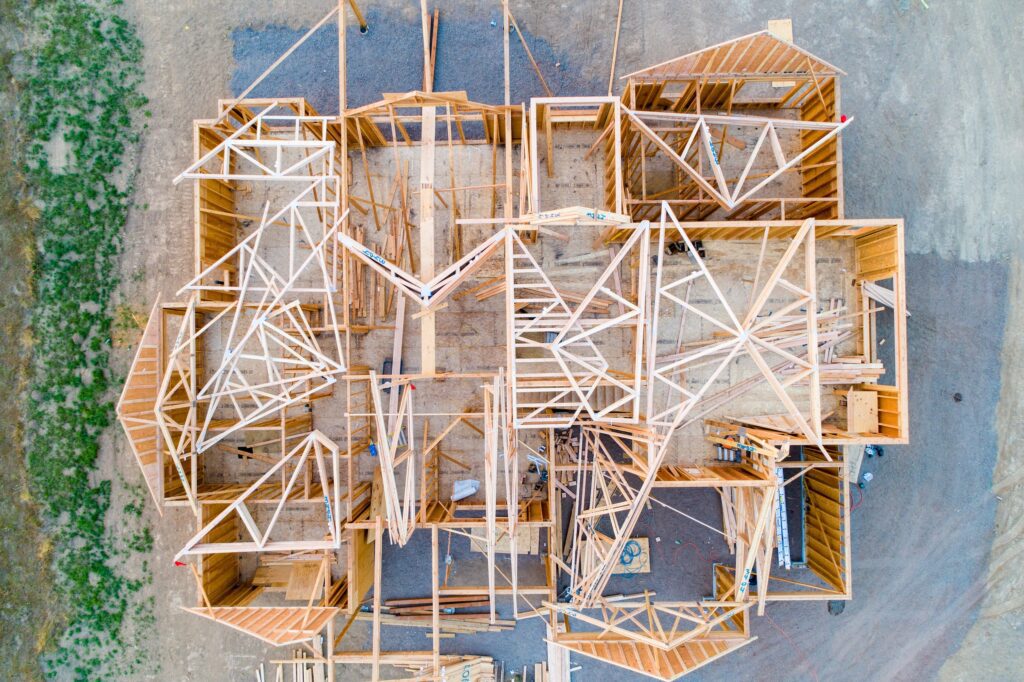

The Boise area consistently suffers from low housing inventory, which is a major factor in market competition. For some soon-to-be homeowners, finding the perfect home that proudly boasts the features they want in a home is easier said than done. Competition in the market can further thwart the chances of finding a dream home, so some homeowners build custom homes to create a beautiful home that emanates their personality and preferences.

Which is Better?

In the grand scheme of the renting versus buying in Boise debate, both have merits. Both options have distinctive perks, making them ideal for specific situations. For example, rentals are a good option for frequent travelers who enjoy flexibility. In contrast, buying is an excellent option for those who want to put down roots and enjoy the tax benefits of homeownership.

| Renting | Buying | |

| Monthly cost | Comparable but varies based on factors specific to home | Comparable but varies based on factors specific to home |

| Initial cost | Lower | Higher |

| Responsibility (maintenance, repairs, etc.) | Less | More |

| Tax benefits | No | Yes |

| Flexibility | More | Less |

| Stability | Less | More |

| Pet-friendly opportunities | Less | More |

But wait – if neither renting nor buying sounds appealing, there’s a third option you should consider: a custom build. With a custom home build, you enjoy every perk from the home buying list, but with a few extra benefits.

You can take the potter and clay analogy to a new level because, unlike a pre-built home, you get to start from scratch. From the layout to the finishing touches, the choices are yours. It’s your chance to bring your dreams to life and create a home that matches your preferences and showcases your aesthetic taste.

Build Your Dream Home With Oakmont

At Oakmont, we’re committed to helping Boise residents craft beautiful, jaw-dropping homes that perfectly emulate their style and preferences. We pride ourselves on our highly customizable process that places control in the soon-to-be homeowner’s hands. Let us walk you through every step of the process, from initial blueprints to finishing touches, to bring those dreams to life.

We also offer an array of stunning move-in-ready homes in and around Boise. So, whether you want the convenience of a move-in ready home or to start from scratch to craft the home of your dreams, our skilled artisans at Oakmont can help. Contact us today to get started.